Reading Between The Lines: James Bullard's Seven Faces of "The Peril" By Chris Ciovacco Preprint Federal Reserve Bank of St. Louis September-October Issue 2010 July 29, 2010 Our interpretation below relates to the asset markets and asset prices. We believe quantitative easing can impact asset prices in the short-to-intermediate term. We do not believe quantitative easing is the solution to the global economy's problems, nor do we believe it will create long-term prosperity or job growth. As money managers, our job is to understand the possible impact of Fed policy on the value of our clients' investments. The short-to-intermediate-term driver of asset prices would be the perception of market participants, right or wrong, that the Fed can create positive inflation. We firmly believe quantitative easing can impact the prices of stocks, commodities, and currencies in the short-to-intermediate term. In that light, we believe quantitative easing, or even the potential for the Fed to buy Treasury bonds, is an important factor in determining investment outcomes in the next six to twelve months. Financial market performance and the long-term economic impacts of quantitative easing are two separate issues. After reading James Bullard's twenty-three page paper on possible monetary responses to further economic shocks, we feel it is important for investors to gain a basic understanding of how future Fed policy could impact the value of an individual's savings and other financial assets. The basic premise of Mr. Bullard's work is as follows:

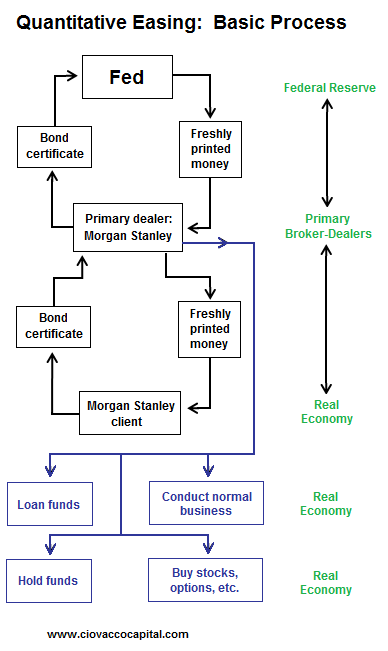

What could all this mean to me and my investments? Let's start with quantitative easing, where the Federal Reserve buys Treasury bonds. The Fed buys the bonds from a network of primary dealers (brokerage firms), such as Goldman Sachs and Morgan Stanley. As a normal part of their business, Morgan Stanley buys and sells bonds from clients, businesses, other dealers, and the Fed (they act as a dealer). The Fed's August 10, 2010 statement clearly states the bond "purchases will be conducted with the Federal Reserve's primary dealers through a series of competitive auctions via the Desk's FedTrade system". If you want to know who is going to get the freshly-printed electronic cash, see the Fed's Primary Dealers List. Using a hypothetical example to illustrate the basic concepts of quantitative easing, assume a typical American citizen has some Treasury Bond certificates in a shoebox under their bed. If they want to sell their bonds, they can deposit them into their Morgan Stanley brokerage account. Morgan Stanley will offer to buy the bonds based on current market prices. Morgan Stanley either sells the bonds immediately to a third-party or they may hold the bonds in inventory to sell at a later date. If the Fed offers to buy the bonds originally in the shoebox under the American's bed, they will be exchanging money, not currently in circulation, for a bond certificate held now by Morgan Stanley. After the transaction runs full circle, the American citizen has newly printed money and the Fed now has the bond certificates. It is easy to see in this example the Fed has increased the money supply by buying the bonds. The Treasury Bond represents an IOU from the U.S. Government. When the Fed buys bonds in the open market, it is like the government buying back its own IOU with newly created money. This is about as close to pure money printing as it gets. The basic process of quantitative easing is illustrated in the graphic below.

How is this policy any different from lowering interest rates or increasing bank reserves? Lowering interest rates and flooding the banking system with cash has one major drawback; if the banks won't issue loans or customers do not want to take out loans, the low rates and excess bank reserves do little to expand the supply of money in the real economy. Therefore, these policies can fall into the "pushing on a rope" category. Quantitative easing, or Fed purchases of Treasury bonds, can theoretically inject cash directly into the real economy, which is a significant difference, assuming the broker/dealers do not sit on the cash they receive from the Fed. How could all this create inflation and why should I care? In a simple hypothetical example, assume we could keep the amount of goods and services available in the economy constant for one year. During that year, the Fed buys enough Treasuries to exactly double the dollar bills in circulation. The laws of supply and demand say if we hold supply constant (goods and services) and double demand (dollars chasing those good and services), prices will theoretically double. Obviously, if the prices of all goods and services doubled, the purchasing power of your current dollars in hand would be cut in half. This is known as purchasing power risk. If the Fed starts buying bonds what could happen? Since the Fed would be devaluing the paper currency in circulation, market participants would most likely wish to store their wealth in other assets, such as gold, silver, oil, copper, stocks, real estate, etc. The mere announcement of such a program would begin to accomplish the Fed's objective of creating an expectation of higher future inflation. The expectation of future inflation can lead to asset purchases and investing, which in theory creates inflation by driving the prices of goods, services, and assets higher. In fact, the creation of this document and your reading of it assist in the process of creating increased expectations of future inflation, which is exactly what the Fed is trying to accomplish. Chicken or Egg: Inflation Expectations or Inflation Mr. Bullard hypothesizes the current economy may need rising inflation expectations to come first, which in turn would help create actual inflation since it would influence the buying and investing habits of both consumers and businesses. If you feel the Fed will "do whatever it takes" to create inflation, you may decide you need to protect yourself from inflation by investing in hard assets, like silver and copper. Your purchases of hard assets would help drive their prices higher. The mere perception of the possible devaluation of a paper currency can change the buying and investing patterns of both consumers and businesses. Wild Card Makes 945 to 1,010 on S&P 500 Difficult From a money management perspective, understanding possible Fed actions, especially before high stress and volatile periods arrive, can assist you in making more rationale and well planned decisions. Even prior to the release of Bullard's paper, we hypothesized some possible market scenarios on July 22, 2010 in Bernanke, the Fed, Deflation, and the Dollar. The comments from July 22nd still apply, but it appears now as if the Fed would move directly to an asset purchase program. How serious is this? We should stress Mr. Bullard's work relates to contingency plans only. He states a deflationary outcome could occur in the U.S. "within the next several years". In a conference call on Thursday, Bullard said, "This is a matter of being ready in case something else hits. What if there's a terrorist attack? What if there is some kind of trouble in the Asian recovery or something like that?" He added, "The most likely possibility from where we sit today is that the recovery will continue through the fall, inflation will start to move up and this issue will all go away". Unfortunately, sometimes when an option is given to the markets, it forces the hand of policymakers. This means markets may remain volatile for a time, maybe even long enough to bring about an announcement of quantitative easing from the Fed. We will continue to comment on this topic from time to time in our blog, Short Takes.

Chris Ciovacco

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com Terms of Use. The charts and comments are only the author's view of market activity and aren't recommendations to buy or sell any security. Market sectors and related ETFs are selected based on his opinion as to their importance in providing the viewer a comprehensive summary of market conditions for the featured period. Chart annotations aren't predictive of any future market action rather they only demonstrate the author's opinion as to a range of possibilities going forward. All material presented herein is believed to be reliable but we cannot attest to its accuracy. The information contained herein (including historical prices or values) has been obtained from sources that Ciovacco Capital Management (CCM) considers to be reliable; however, CCM makes no representation as to, or accepts any responsibility or liability for, the accuracy or completeness of the information contained herein or any decision made or action taken by you or any third party in reliance upon the data. Some results are derived using historical estimations from available data. Investment recommendations may change and readers are urged to check with tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. |