|

Home

|

How Far Could Stocks Fall? Probabilistic Study of the Stock Market’s Downside Risk (2010-2011) November 17, 2010

Due to the following factors, we continue to believe the downside risks in the stock market are manageable in the short-to-intermediate-term:

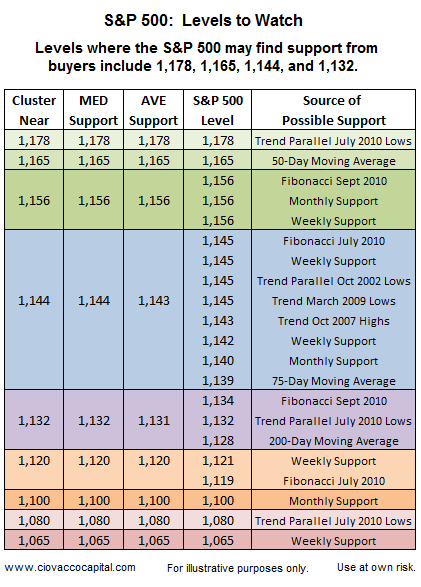

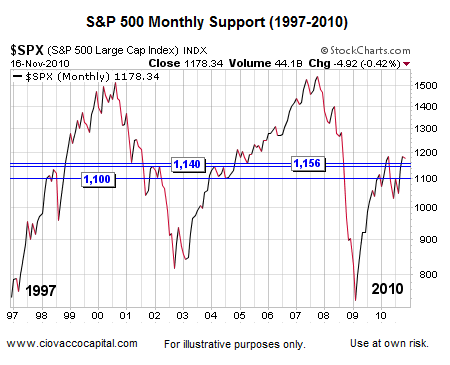

The eight charts of the S&P 500 below show how we compiled the table above. Traders and investors use various tools and examine various timeframes when making allocation decisions. Areas of potential support, or interest from buyers, are more meaningful when they appear in various timeframes and are determined using various methods. Below, we examined areas of past support and resistance on a monthly chart of the S&P 500 going back to 1997. Key levels clustered near 1,156, 1,140, and 1,100.

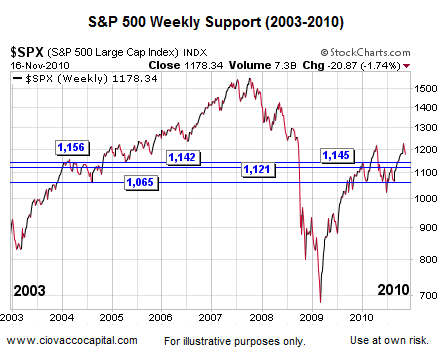

The weekly chart below allows us to look at a little more detail going back to 2003. Key levels tended to cluster near 1,156, 1,145, 1,142, 1,121, and 1,065.

The chart below looks at parallel trend lines on the S&P 500 from the October 2007 highs. If the current day market were to fall further, it may find support from the top pink line near 1,143.

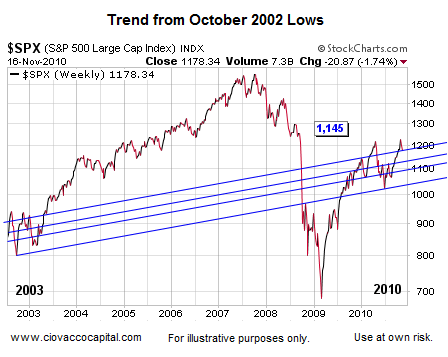

Below, we review parallel trendlines from the October 2002 lows. Notice how markets tend to have long memories relative to parallel trends. Possible support from the top blue line comes in near 1,178; the next line would come into play somewhere near 1,145.

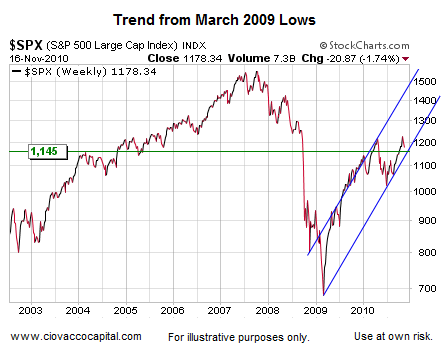

The chart below looks at the trendlines from the March 2009 lows. It appears as if the S&P 500 would intersect with the lower blue trendline somewhere in the neighborhood of 1,145.

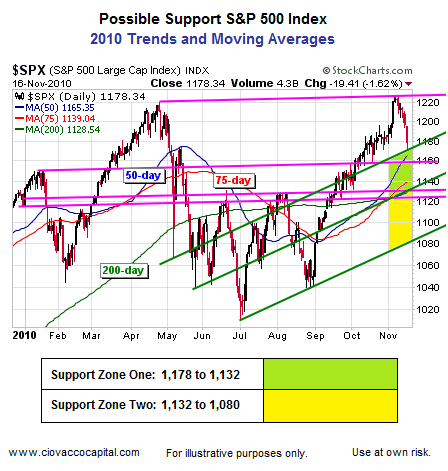

This chart (below) looks at a much shorter-term view. The green lines are parallel trendlines from the July 2010 lows. The pink lines are parallel trendlines connecting the April and November 2010 highs. Moving averages for the S&P 500 are shown via the blue, red, and green thin lines. This chart has two major zones of potential support highlighted in green and yellow. A break of the lower green trendline would be a cause for concern (currently near 1,080).

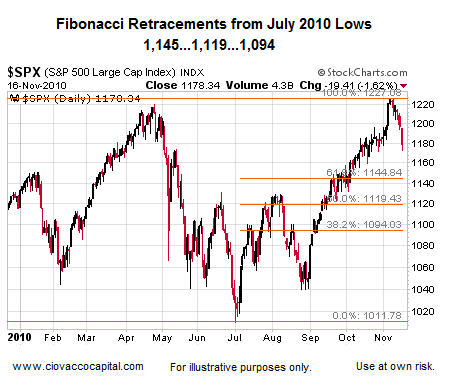

Traders often watch Fibonacci retracement levels; so it pays to keep these in your back pocket. The basic concept is all markets have natural ebb and flow where “giving back” some gains is a normal part of any healthy market. Retracements bring new buying interest and allow markets to move higher. The chart below shows the retracement levels for the gains made from the summer low to the recent fall 2010 high.

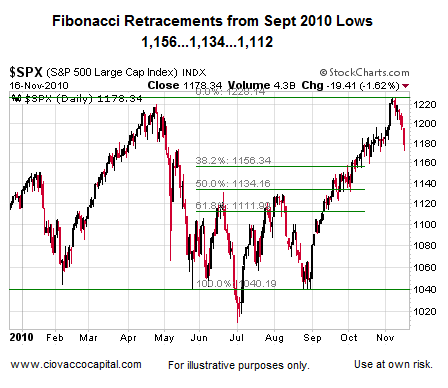

Below, are the levels using the more recent September 2010 low matched with the most recent high in the S&P 500.

The summary table at the top of this page aggregates the areas of possible support garnered from various timeframes and various methods. In the short-to-intermediate term, the key levels where buyers may become interested in risk assets correspond to S&P 500 levels of 1,156, 1,144, and 1,132. Trendlines, support, and retracements levels are violated commonly in all markets, which speak to the probabilistic nature of this analysis. A break of 1,144 on the S&P 500, especially on a weekly closing basis, would increase the odds that any pullback may be more than a normal correction within a healthy market. Developments in Europe and new fundamental data need to be factored into all investment decisions, and should be used in conjunction with possible areas of buying support. The U.S. dollar's recent rally has not yet morphed into something that looks to have staying power; see Risk On Trade May Be Back for more charts and details.

Videos on Investing and Quantitative Easing.

Chris Ciovacco

Terms of Use. The charts and comments are only the author's view of market activity and aren't recommendations to buy or sell any security. Market sectors and related ETFs are selected based on his opinion as to their importance in providing the viewer a comprehensive summary of market conditions for the featured period. Chart annotations aren't predictive of any future market action rather they only demonstrate the author's opinion as to a range of possibilities going forward. All material presented herein is believed to be reliable but we cannot attest to its accuracy. The information contained herein (including historical prices or values) has been obtained from sources that Ciovacco Capital Management (CCM) considers to be reliable; however, CCM makes no representation as to, or accepts any responsibility or liability for, the accuracy or completeness of the information contained herein or any decision made or action taken by you or any third party in reliance upon the data. Some results are derived using historical estimations from available data. Investment recommendations may change and readers are urged to check with tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

|