Technical Analysis: Understanding Stock Market Basing Patterns - Consolidation

Patterns and Market Trends

By Chris Ciovacco

Ciovacco Capital Management

ATLANTA

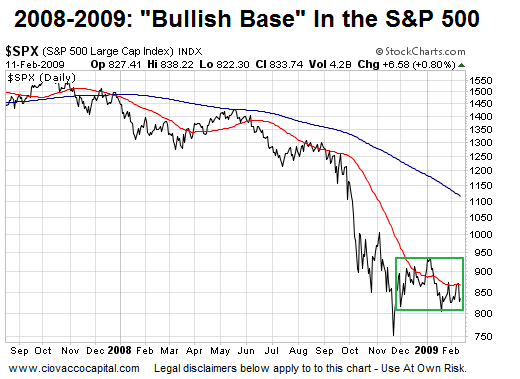

Investing in the financial markets requires the assessment of probabilities for both positive and negative outcomes. You should approach the market with neither a bullish nor a bearish bias. The S&P 500 has been holding up relatively well since the November 20, 2008 low. A sideways pattern in the markets is often referred to as a base. Wall Street, as a whole, is predisposed to view the markets with a significant bullish bias. Consequently, the S&P 500's recent basing pattern has been met with almost a universally positive reaction.

During a bear market bases can have bullish implications as a market bottom tends to occur over time. We have touched on this topic in Bear Markets Tend To Retest Lows. We have also acknowledged recent positive developments in market breadth since the November 2008 lows (see Breadth, "Accounting Problems", and Gold).

In 2009, another feather in the bearish cap is sentiment. Many indicators paint somewhat of a carefree reaction to the market's big drop after the government's PR disaster on Tuesday (2/10/09). Sentiment is a contrary indicator. When people are bullish or complacent, the stage is set for possible losses. More information on current sentiment can be found in Mark Hulbert's article What Me Worry?.

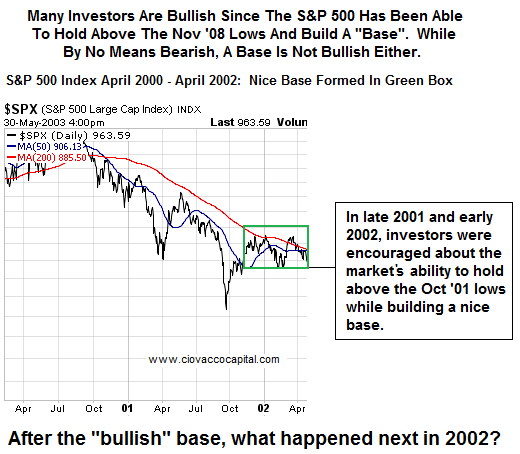

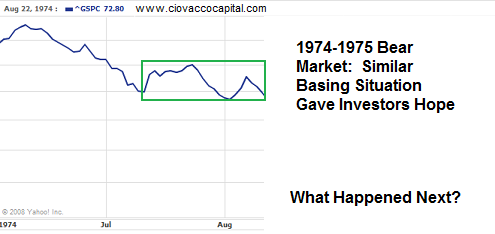

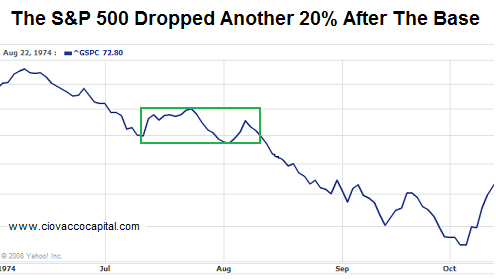

While acknowledging a basing pattern can be a sign of a bottoming process and precede bullish outcomes, history suggests a base during a bear market can also occur just prior to another painful leg down for investors. In both the 2000-2002 and 1974-1975 bear markets, investors were bullish as bases formed.

The primary trend in stocks remains down, which means the odds favor lower lows after this base. If we were in a bull market, odds would favor higher highs after a base. We are not in a bull market. The purpose of this commentary is not to make a bearish forecast for the 2009 markets, but rather to highlight the need to balance the lopsided reaction to the market's recent base.

Chris Ciovacco

Ciovacco Capital Management

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

All material presented herein is believed to be reliable but we cannot attest to its accuracy. The information contained herein (including historical prices or values) has been obtained from sources that Ciovacco Capital Management (CCM) considers to be reliable; however, CCM makes any representation as to, or accepts any responsibility or liability for, the accuracy or completeness of the information contained herein or any decision made or action taken by you or any third party in reliance upon the data. Some results are derived using historical estimations from available data. Investment recommendations may change and readers are urged to check with tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

|