|

Home

|

Is The Fed Bailing Out Europe?With the S&P 500 heading toward the October lows on the Friday after Thanksgiving, the ever market manipulating central banks just had to do something. The decision was made on Monday, November 28 to provide a stealth bailout for European banks, and indirectly poorly managed sovereigns. Gerald Driscoll, the former Vice President of the Federal Reserve Bank of Dallas, penned an opinion piece which appeared in the Wall Street Journal on December 28. He stated in no uncertain terms:

No matter the legalistic interpretation, the Fed is, working through the ECB, bailing out European banks and, indirectly, spendthrift European governments. It is difficult to count the number of things wrong with this arrangement.

In the video below, we cover the Fed’s backdoor bailout of Europe, along with:

After you click play, use the button in the lower-right corner of the video player to view in full-screen mode. Hit Esc to exit full-screen mode.

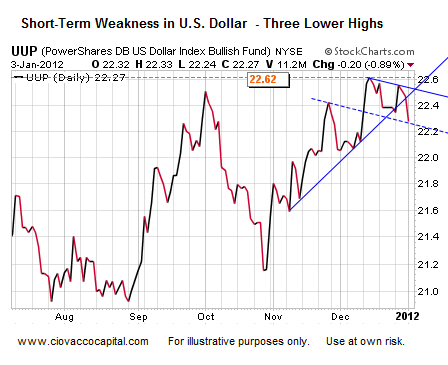

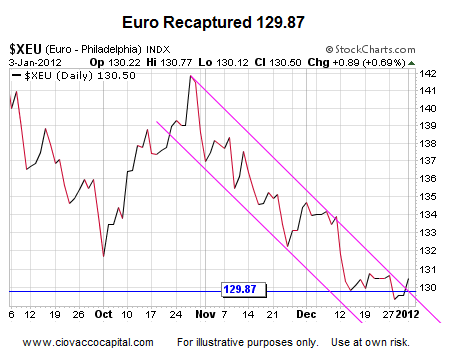

Under “normal” market conditions, banks assist each other with short-term needs via overnight loans. When banks are concerned about the assets on the books of other banks (European debt), they avoid lending to each other. The European Central Bank (ECB), which is fast eclipsing the Fed as King of The Bank Bailouts, is happy to help “private” banks with their funding needs when trust between banks is low. Therefore, when the ECB is making a lot of overnight loans to banks, it shows (a) ongoing concern about balance sheets, (b) lack of trust, and (c) concerns about getting paid back (see MF Global). Banks borrowed 17.3 B euros from the ECB last Thursday, 14.8 B on Monday, and 15 B on Tuesday, which according to the Financial Times is “exceptionally high even by standards set during the turbulent past few months”. On December 28, we noted action in the euro and U.S. dollar would influence risk assets. The U.S. Dollar ETF (UUP) has failed to recapture 22.62 and closed below its 20-day moving average on Tuesday, which may point to further gains in stocks over the coming days/weeks.

We are here today (Tuesday) with stocks ripping higher in Europe and the U.S while the European bond market is flashing warning lights. And the message out of the European bond market is that all is not well. The yield on Italian 10-year notes are just south of 7%. Spanish bond yields are slightly higher on the day after the country revealed that its budget deficit could clock in north of 8% of GDP for 2011, instead of 6%. Plus there’s more austerity on the way for Spain in the form of tax hikes and spending cuts. That’s not going to help a Spanish economy already far into the doldrums. Here’s Jens Nordvig of Nomura, who has been bearish on the euro, with his take:Global risk assets are kicking off 2012 on a bullish note. But Eurozone sovereign debt markets are lagging in the rally, and the Italian 10-year bond yield continues to trade close to 7% (which implies significant default risk). Continued tension in some of the biggest Eurozone bond markets implies that Eurozone break-up risk remains real as we move into 2012. After reviewing the daily and weekly DeMark counts for all the ETFs we follow, the current rally may run into trouble with a few successive closes above 1,285 on the S&P 500. We are currently taking a somewhat neutral/wait-and-see approach until we see how the S&P 500 acts above 1,285. Terms of Use. This video/article/blog contains the current opinions of the author but not necessarily those of CCM. The author’s opinions are subject to change without notice. This article is distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. The charts and comments are only the author’s view of market activity and aren’t recommendations to buy or sell any security. Market sectors and related ETFs are selected based on his opinion as to their importance in providing the viewer a comprehensive summary of market conditions for the featured period. Chart annotations aren’t predictive of any future market action rather they only demonstrate the author’s opinion as to a range of possibilities going forward. All material presented herein is believed to be reliable but we cannot attest to its accuracy. The information contained herein (including historical prices or values) has been obtained from sources that Ciovacco Capital Management (CCM) considers to be reliable; however, CCM makes no representation as to, or accepts any responsibility or liability for, the accuracy or completeness of the information contained herein or any decision made or action taken by you or any third party in reliance upon the data. Some results are derived using historical estimations from available data. Investment recommendations may change and readers are urged to check with tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

|